In this week’s blog Nuala McGowan, CPA, ACA, AIA and founder of McGowan Accountancy Services looks at Capital Gains Tax (CAT) and highlights the important dates that determine the rates and the group threshold that apply.

The date of a gift is normally the date it is received. The date of an inheritance is usually the date of death of the person leaving the inheritance.

These dates determine the Capital Acquisitions Tax (CAT) rates and the group threshold that apply. The person who gives the gift or inheritance is called the disponer. The person who receives the gift or inheritance is called the beneficiary.

Valuation date

The valuation date is the date on which the value of the property and assets is established. It determines which date the tax is payable and your CAT returns are due to be filed. Where the valuation date is:

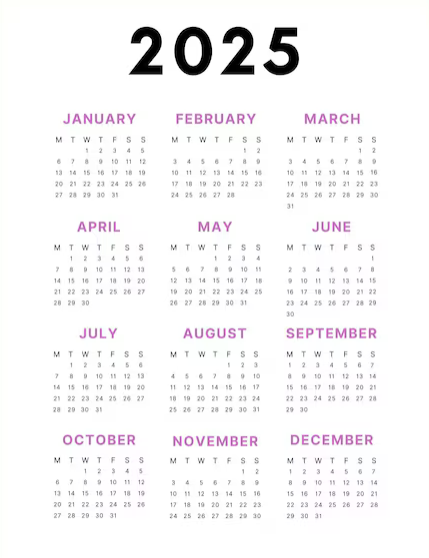

- between 1 January and 31 August, the pay and file deadline is 31 October in that year

- between 1 September and 31 December, the pay & file deadline is 31 October in the following year.

For more information on this topic contact Nuala McGowan on 090 66 25818 or 086 0352849 or email nuala@mcgowanaccountancy.com